Ron Bauer, Founder of Theseus Capital

Over the last year, the pound has fallen due to fears of a recession, a terrible energy deficit, and the worst inflation among G7 countries. Last Friday, the GBP fell to a 37-year low against the dollar as financial markets responded to the most significant tax cuts in the previous half-century.

On the other side of the spectrum, the dollar has been at its highest against various currencies in the last two decades, driven by the high-interest rates levied by the US Federal Reserve system. Moving forward, the decline of the GBP coupled with the dollar’s strength creates a fantastic opportunity for overseas investors that should be seized on.

Source: PoundGBPLive

Uncovering the Causes behind the Decline of the GBP

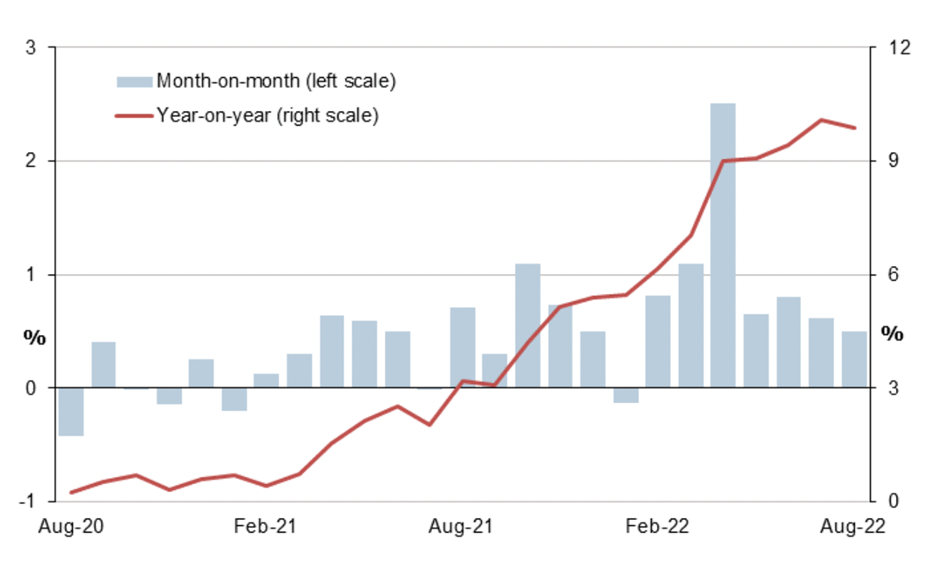

Without a doubt, the currency’s decline reflects the worsening economic outlook for the UK. The current inflation rate is approximately 9.9%, the highest since the 1980s and expected to reach 11% in the following months. The government has attempted to address this tendency in several ways, including the Bank of England’s repeated hikes in interest rates to 1.75% this year, with more rises predicted by year’s end. As it hiked interest rates, the bank declared that the UK might already be in recession, defined as two consecutive quarters of economic loss. Since the cost of borrowing grows, there are increasing concerns that rising interest rates would discourage investment.

After months of significant decline, the value of the GBP plunged even more on 23 September when Chancellor Kwasi Kwarteng unveiled the largest package of tax cuts in fifty years. Investors are unsure how Chancellor Kwarteng can afford the most drastic package of tax cuts for the UK since 1972 since the move is expected to drive even greater inflation and push the Bank of England to tighten monetary policy more aggressively. Over the next five years, the cut in taxes on worker wages and business profits will cost as much as £161 billion.

UK Inflation Evolution: August 2020 – August 2022

Source: Focus Economics

Ron Bauer, Founder of Theseus Capital

Another primary cause which is behind the decline of the GBP is represented by the ongoing energy crisis. Considering Russia’s status as a critical supplier of oil and gas, the invasion of Ukraine has significantly impacted the global economy. Hence, oil and gas costs have skyrocketed due to the sanctions imposed by the EU, and energy businesses are compelled to increase their rates to compensate. Soaring energy costs have caused a problem in the cost of living, as many are obliged to conserve money for their heating and electricity, so they cease spending, which is detrimental to the economy.

Likewise, political turmoil is leading GBP to decline. In recent months, the pound has been affected by additional factors such as the growing number of proposals for Scottish independence and debates about Northern Ireland’s post-Brexit commercial deals. In a tight election, Liz Truss has succeeded Boris Johnson as Prime Minister, and many are uncertain if her economic policies would do enough to assist those impacted by the cost of living problem.

Where are we headed?

As the British pound falls to its lowest level since 1985, there are rumours of an impending currency crisis. In this scenario, the pound’s value would decline, as would living standards. Currency crises are uncommon in stable, industrialised nations and more often in economic basket cases such as Argentina and Venezuela.

Citi’s Vasileios Gkionakis declared, “the UK will find it increasingly difficult to finance this deficit amidst such as deteriorating economic backdrop; something has to give, and that something will eventually be a much lower exchange rate.”

Multiple analysts, including the British Chambers of Commerce, have already predicted that the UK will enter a recession prior to the end of the year. In one of the direst forecasts to date, Goldman Sachs predicted that next year’s UK inflation might exceed 22% due to rising energy prices. The bank believes the British economy would drop 3.4% under such conditions.

Seizing the Opportunity to enter the UK Market

The UK is currently experiencing political upheaval due to a change in leadership, significant costs associated with supporting the war in Ukraine, and a general market downturn, creating the ideal conditions for a strong dollar and an unprecedented buying opportunity. In the context of a weak GBP, international investors are advised to capitalise on the weakening of the pound by putting their money to work as soon as possible so that they may maximise the profits they will gain on their investments after the pound has stabilised after the current period of volatility.

Notwithstanding its current dire economic circumstances, the UK still represents an attractive market for US companies and funds to come here and invest heavily. Some of the core advantages of the UK are its consumer market, which is known for high spending levels, an open and liberal economy, talent on par with the best in the world, and a regulatory landscape favourable to the business of the UK. Furthermore, the UK offers one of the world’s greatest and most ambitious ecosystems for the growth of innovative enterprises.

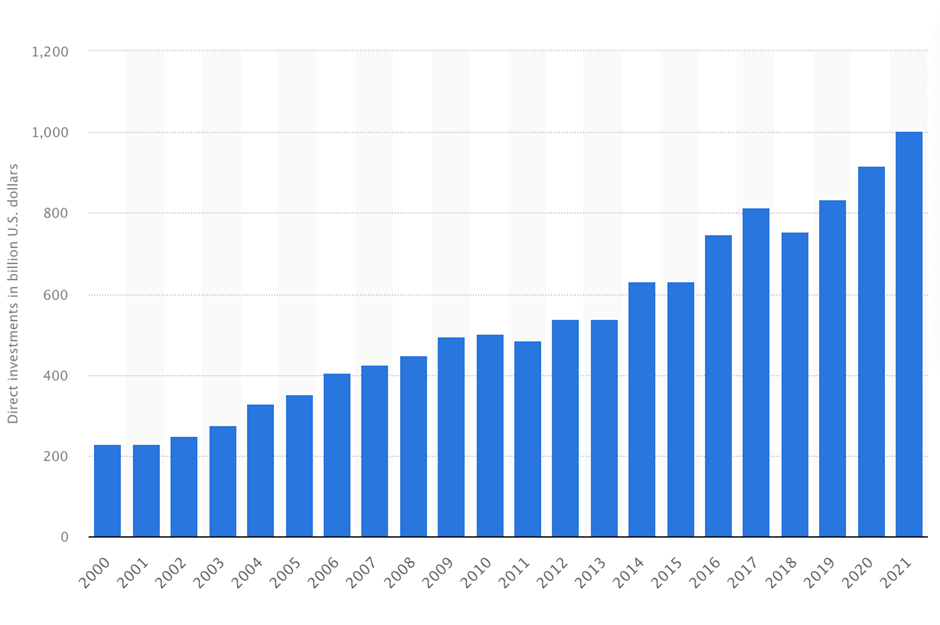

Direct investment position of the US in the UK: 2000 – 2021

Source: Statista

The US is the UK’s biggest investor. It is estimated that American corporations have invested around $600 billion in the British market. This represents about a quarter of their entire investment in Europe and more than 12% of US foreign direct investment (FDI) worldwide.

After a record £29.4 billion was invested in UK companies in 2021, venture capital remained a crucial asset class for sophisticated and high-net-worth investors. Overall, the UK has a favourable environment for foreign investors, with limits on foreign equity participation in a small number of industries covered by the Investing Across Sectors indicators.

If the British pound continues to decline, the exchange rate will favour foreign currencies. In other words, you may invest for less money than before the value of the pound started to decrease since the decreasing value of the pound has made UK assets relatively cheaper. To put it another way, this is the ideal moment to invest in the UK, as overseas investors may maximise their capital by taking advantage of favourable exchange rates. Due to the relative stability of the housing market, real estate investment is particularly advantageous.

Bottom Line

Since the US dollar is so strong relative to the GBP, this presents an opportunity for US enterprises with cash, private equity firms with cash, hedge funds, institutions, and NASDAQ and NYSE public companies to acquire or invest massively in the UK. Ultimately, the UK’s political upheaval caused by the change in leadership, significant costs associated with supporting the conflict in Ukraine, and a general market decline have produced the ideal conditions for a strong dollar and a significant buying opportunity in the UK.

ABOUT RON BAUER – THESEUS CAPITAL – www.thescapital.com

Ron Bauer is a venture capitalist, entrepreneur, business mentor and author, with over 20 years of experience. He is focused on the Life Sciences, Technology, EdTech and Natural Resources sectors, where he has created several exciting ventures side by side with some of the world’s leading entrepreneurs and scientists as well as world class academic institutions. Ron holds a Master of Business Administration (MBA) degree from the University of Cambridge.

Ron was the Co-Founder of Turkana Energy, which merged with Africa Oil (TSX: AOI) in July 2009. The company went on to have a peak market value of over $3 Billion CAD, having raised more than $1 Billion of equity after Tullow Oil successfully drilled Turkana’s oil concession. Ron is a principal investor in many biotech, tech and natural resources companies. Recently, he was a principal investor in 180 Life Sciences (NASDAQ: ATNF), Pasithea Therapeutics (NASDAQ: KTTA), Stran & Co (NASDAQ: STRN), Genflow Biosciences (LSE: GENF), Hemogenyx Pharmaceuticals (LSE: HEMO), and Cognetivity Neurosciences (CSE: CGN).