No industry escaped the COVID-19 pandemic unscathed, and the real estate sector was particularly hard hit, with sales dropping by 92.7 percent in some European countries. The pandemic will continue to influence the global workforce, consumer behavior, and real estate markets for an extended period of time. The good news is that a number of nations’ real estate markets are exhibiting strong signs of recovery.

This trend is in part being driven by the fact that an increasing number of renters are becoming aware of the advantages of home ownership, and an increasing number of businesses are searching for low-cost office space to accommodate a hybrid workforce. For instance, the office market in Spain is expanding, and as a result, rents have risen noticeably in recent months. This expansion has been fueled by an improvement in economic fundamentals and higher levels of productivity, as well as an increase in demand from consumers worried about the potential impact of a pandemic on the nation. Comparable to Spain, the residential real estate market in Eastern Europe operates similarly. The demand for office space in Eastern Europe has increased significantly as the economy continues to grow and expand. This increase in demand is driven primarily by high-tech companies looking for space with lower operating expenses.

With that said, anyone considering investing in real estate right now should proceed with caution. The markets are still volatile, and new variants of the novel coronavirus may emerge.

Here are a few things to consider before investing in real estate;

Identify Emerging Markets

One of the biggest impacts of the pandemic has been the emergence of new real estate markets. Whether you’re buying a property in your home country or overseas, it’s essential to keep an eye on these emerging markets.

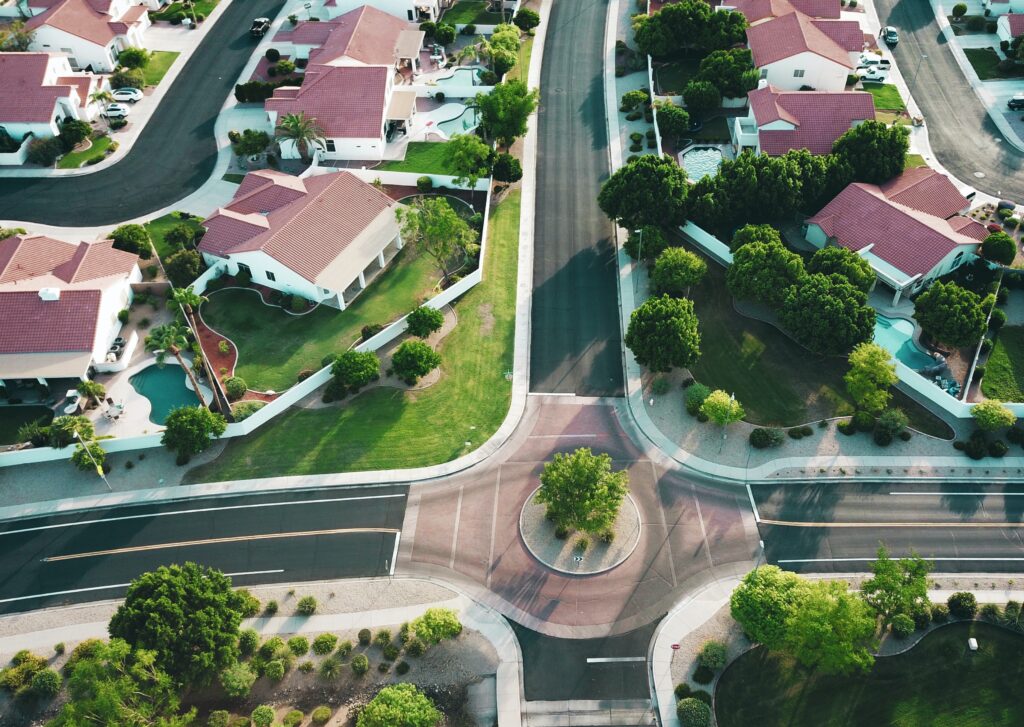

For instance, the hottest pre-pandemic markets in Europe included popular cities, such as London, Paris, Kieve and Berlin. But today’s homebuyers are gravitating to quieter and less crowded suburbs and has resulted in the rise of new markets.

Before investing in any new market, make sure you analyze various factors that may indicate whether the region will yield high returns in the long run

- Average housing rent and prices

- Unemployment rates

- The number of new construction projects

Some of the interesting markets today in Georgia are the Vake district and Saburtalo in Tbilisi. Other Central and East European cities, such as Warsaw, Budapest, and Prague, have also caught the eye of investors.

These cities are known for their relative political stability, low employment rates, and steady economic growth. Also, property prices are more affordable compared to established markets.

Explore Different Sectors

Every sector, including housing, retail, and commercial real estate, has experienced more ups than downs over the last two years. Retail projects have undergone massive transformation owing to changing consumer preferences.

Today, investors are more interested in building open-air shopping centers and convenience stores than traditional shopping malls.

Similarly, the commercial real estate sector suffered when companies switched to remote work in 2020. While it was adopted as a pandemic survival strategy, many organizations have made remote work a staple. That means the demand for large office spaces will likely decline.

Consider Commercial Real Estate Investments

As more professionals start working remotely, they’ll be on the lookout for affordable co-working spaces and workstations. At the same time mid-sized and larger corporations are looking for company space that accommodates all of their workers’ needs. Both scenarios present new opportunities for commercial real estate developers and investors.

Similarly, regions with growing entrepreneurial activity create the need for premium business complexes. Vake Plaza in Tbilisi is one example of what a modern business must accommodate to meet the needs of today’s businesses. The ambitious project aims to build a modern fully-managed business center in one of Tbilisi’s most sophisticated neighborhoods. The project addresses many of the challenges companies face with features, such as high-end security systems and an uninterrupted power supply.

Also, it resolves Tbilisi’s pressing problem of accessible parking spaces. Vake Plaza offers a sprawling underground parking lot, thus saving business owners and working professionals the trouble.

If you’re looking to invest in the commercial sector, identify regions that are emerging as hubs of entrepreneurship. Also, study the market to understand the problems businesses face and make sure your project addresses those challenges.

Suburbs around popular cities, such as Prague and Budapest, offer immense opportunities when it comes to housing. The suburbs offer affordable prices with better potential for appreciation in the future. Also, it’s where today’s homebuyers are moving in search of properties with huge outdoor spaces.

Creating a Backup Plan

According to a recent PwC report, real estate investors have developed a preference for properties that can be repurposed and repositioned. Considering that many real estate investors had to pivot their strategies due to the pandemic, it’s understandable.

Whether you’re investing in housing or commercial real estate, make sure you’ve got a backup plan to generate income during periods of economic decline, geopolitical turmoil, etc.

For instance, if your investments include housing assets, you could turn them into short-term vacation rentals. As the trend of working while traveling gains traction, so will the demand for short-term rentals.

Similarly, investors in the retail sector can consider renting shopping mall space to cloud kitchens. Or they could overhaul the design to create modern open-air entertainment centers.

The idea is to have a strategy to reposition your assets according to changing market conditions.

Final Takeaways

A complete assessment of the pandemic’s impact on real estate won’t be available for a few months at least. But investors can harness emerging markets in cities and suburbs to diversify their portfolios. Make sure you study the real estate market in any region that has caught your attention.

About the Author David Kezerashvili

David Kezerashvili is active in global real estate investments with development projects across the globe with a focus on his native Georgia. To contact him or learn more about his projects click here.